PROTECT YOUR DNA WITH QUANTUM TECHNOLOGY

Orgo-Life the new way to the future Advertising by Adpathway

Article content

Equipped with fleets of white delivery vans and a catalogue of distribution warehouses, last-mile delivery startup UniExpress Inc. — more commonly known as UniUni — in many ways resembles established rivals such as FedEx, United Parcel Service Inc. and Canada Post Corp.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

From its Richmond, B.C., headquarters located near the Vancouver International Airport, UniUni delivers everything from $5 dresses and bedazzled iPhone cases to bulk cleaning supplies and health supplements to shoppers across North America. It said it annually ships hundreds of millions of packages from e-commerce juggernauts such as Shein, Temu and Amazon.com Inc., in addition to smaller, independent retailers.

Article content

Article content

Article content

Although the company looks like many other delivery services from the outside, it claims to have a secret sauce: a network of on-call drivers, tech-driven warehouses outfitted with sorting robots and a delivery platform that prizes algorithmic efficiency in an increasingly crowded delivery market that had 31,274 competitors in 2024, according to IBISWorld Inc. data.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Customers seem to have bought in. In 2024, UniUni’s three-year revenue growth rate hit nearly 13,000 per cent and its headcount surged 46 per cent over the previous year, making it one of Canada’s fastest-growing companies.

Article content

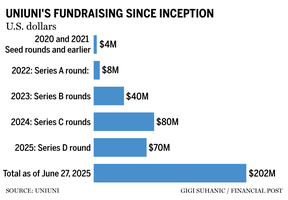

Investors have bought in, too. The company has raised US$202 million from international and Canadian investors in its six years of operation, including a $70-million round completed last week. It declined to share its current valuation.

Article content

But UniUni’s rise has been partly blemished by questions about its labour practices, including allegations of unpaid and late wages and reports that drivers were sleeping in warehouses, dozens to a room.

Article content

That could be the only thing standing in the way of the company becoming Canada’s next unicorn — a startup valued at $1 billion or more — an achievement that would make it a standout in the country’s struggling scale-up scene.

Article content

Article content

Article content

Hot streaks

Article content

Article content

British Columbia-based entrepreneurs Peter Lu and Kevin Wang founded UniUni in 2019. The duo initially launched the app as a food delivery service, a space that was rapidly growing as platforms such as DoorDash and Uber Eats jostled for market dominance.

Article content

But when UniUni landed its first major contract that year — delivering for fast fashion titan Shein after someone distantly connected to the retailer spotted a UniUni van in Vancouver — Lu and Wang threw all their energies into parcel deliveries and rode the coattails of an e-commerce boom driven by the COVID-19 pandemic.

Article content

If serendipitous timing was the linchpin of UniUni’s early development, then an unabashed drive to court new investors and a focus on expansion and efficiency through technology have supported its rapid growth.

Article content

UniUni said it has the capability to process millions of parcel deliveries per week in North America. Its 825 employees and network of 50,000-plus delivery drivers sort and move goods from its 100 warehouses to customers across 500 cities in Canada and the U.S. while charging clients much less than its competitors.

Advertisement 1

Advertisement 2

Article content

“(We) deliver as fast as DHL, but for less than half its price,” Lu told Celtic House Venture Partners in March.

Article content

UniUni’s in-house-developed platform, powered by artificial intelligence, optimizes delivery routes and drop-off locations for drivers, and can sort through millions of orders at once, according to the company.

Article content

UniUni has also teamed up with tech vendors to maximize efficiency. For example, it announced a tie-up in April with London-based GLP Pte. Ltd. (doing business as Global Robotics Services) to use its AI-powered navigation, monitoring and sorting systems to more accurately process more deliveries while relying less on manual labour.

Article content

“This reduces the per-parcel processing cost and strengthens margins, especially during high-volume periods,” Lu said.

Article content

They were very fast to market and to aggressively finance themselves

Charles Plant, co-CEO, ExactBlue Technologies Inc.

Article content

The lower prices offered by the likes of UniUni have cut into Canada Post’s market share of e-commerce deliveries and revenues in recent years. The Crown corporation’s monopoly of a waning letter delivery market is also affecting its bottom line, with the Industrial Inquiry Commission recently warning that the postal service is “effectively insolvent or bankrupt.”

Article content

Article content

Startup watchers appreciate that UniUni has embraced risks, a characteristic some say is in short supply in Canada.

Article content

“They were very fast to market and to aggressively finance themselves. The company has raised funds every year since its founding,” said Charles Plant, co-chief executive of nanotechnology firm ExactBlue Technologies Inc. and an adviser who publishes research on Canada’s startup and venture-capital ecosystem.

Article content

Capturing the backing of global investors gave them an added advantage, he said.

Article content

“Five of their seven lead funders are foreign,” Plant said. “Canadian companies funded by international investors have better stats than those funded by solely Canadian ones.”

Article content

UniUni tapped into those funds to quickly expand. Its delivery network now covers 80 per cent of the Canadian population and 60 per cent of the American population. It has launched U.S. hubs in cities such as Los Angeles, New York and Dallas, and is set to hire 100 new people in North America over the next year.

Article content

“They weren’t complacent. They grew to lots of new markets and replicated,” Darrell Kopke, a professor of entrepreneurship and innovation at the University of British Columbia (UBC) and a course leader at Toronto-based incubator Creative Destruction Lab, said.

Article content

Article content

“If you’re a later-stage investor looking at Series B or Series C (funding), what you want to see is consistent growth, and that’s what UniUni has been able to achieve.”

Article content

Article content

Growing pains

Article content

Yet UniUni’s efficiency-at-all-costs mindset — a Silicon Valley-esque way of operating — has mired the company in a web of labour and employment controversies.

Article content

Lu credits its crowdsourced network of delivery drivers, who are self-employed or employees of other delivery service providers, for “greatly” reducing labour costs. On-call gig workers mean that the company is always aligned with real-time demand. For example, the company can tap into more drivers during busy holiday seasons and request fewer during quiet weekdays.

Article content

“To have this chain of drivers sitting around waiting for the next order… that’s the most advantageous for them,” Plant said.

Article content

UniUni is now facing lawsuits in California that allege the company violated the state’s labour laws by failing to pay wages and overtime salaries and to keep proper payroll records.

Article content

Multiple media reports have documented UniUni’s delivery drivers sleeping in a Connecticut warehouse — with a dozen mattresses in one room — to make their morning deliveries. Recent online reviews by workers gripe about the company’s “very low pay,” while others claim managers ask them to work overtime without compensation.

Article content

Customers have also flooded online forums with complaints of lost and stolen deliveries and tales of drivers refusing to drop off their parcels. UniUni says that it has a Better Business Bureau rating of A+ and that “reported package theft is quite rare and well below industry averages.”

Article content

Industry voices contend that UniUni is experiencing growing pains. “Every scale-up, or high-growth company, has had its fair share of complaints,” Kopke said. For example, Uber Technologies Inc. has lurched from scandal to scandal — including, but not limited to, claims of sexual harassment, spying on users and underpaying drivers — but has come to dominate North America’s rideshare market, with a valuation closing in on US$190 billion.

Article content

“If you’re trying to grow that fast, it’s going to be messy,” Plant argued.

Article content

They have a responsibility to make sure that these workers are getting the same level of rights as the law provides

Eleni Kassaris, leader of the employment and labour group at law firm Dentons

Article content

Lu said UniUni’s system benefits its drivers, letting them pick when and where they want to work, while shoppers get faster delivery times. Labour rights experts see it slightly differently.

Article content

“In an ideal world, it can be win-win,” Eleni Kassaris, a Vancouver-based partner and leader of the employment and labour group at law firm Dentons, said. “But we don’t live in a world where it’s easy for people to set their own schedules and work as little or as much as they want; that would imply that gig workers are making a ton of money for a few deliveries. That’s not the case for everyone.”

Article content

Article content

UniUni declined to comment on the lawsuits, but said “the company is fully committed to complying with all labour laws in every jurisdiction where it operates.”

Article content

Those standards differ from province to province and state to state. Last year, B.C. became the first province to amend its labour and employment rules to classify gig workers as employees rather than independent contractors, meaning they’re entitled to specific minimum wages and other benefits like expense allowances for using personal vehicles and workers’ compensation coverage.

Article content

According to B.C. law, UniUni is the employer of any driver using its platform, whether they’re self-employed or employed through other delivery service providers (DSPs), Kassaris said. All its drivers use the company’s platform to deliver parcels.

Article content

“They have a responsibility to make sure that these workers are getting the same level of rights as the law provides,” she said.

Article content

The company can also contractually require the DSPs it works with — who independently manage and compensate their drivers — to pay in accordance with applicable employment and labour laws, and also ask for audit rights to ensure that they’re following the rules, Kassaris said.

Article content

Article content

UniUni said it “contractually requires DSPs to comply with all applicable laws, including applicable employment laws. Standard contracts … do include audit rights.”

Article content

New rules to play by could help solve matters. Legislation is coming into force in Ontario that will look like B.C.’s gig worker protections. That momentum is likely to expand to other Canadian provinces, according to Kassaris.

Article content

“It’s a first step and the story of what we do with online platform workers will continue to evolve,” she said. “There is some middle ground where we can protect workers but also allow innovative business models to flourish.”

Article content

Article content

Risks and rewards

Article content

UniUni’s labour disputes could create reputational risk, but some say that is unlikely to change the tune of investors.

Article content

“Investors aren’t a monolith,” Kopke said. “Given UniUni’s traction, they’ll have no trouble finding the right investors or taking the company public … if they continue performing financially.”

Article content

Iain Klugman, chief executive of NorthGuide, a Waterloo, Ont.-based consultant focused on entrepreneurship and innovation, said UniUni is on the right path by concentrating on growing big, which is a tried-and-tested strategy consistent with successful startups.

Article content

“Market size and growth rates are key to valuation. That’s where they’ve been focusing and it’s the right place to be in,” he said.

Article content

The company, according to a 2023 interview with the Logic, is shooting for a late 2025 or early 2026 initial public offering (IPO) on the Nasdaq or the New York Stock Exchange and may consider a dual listing on the Toronto Stock Exchange.

Article content

It also aims to become a unicorn and to be profitable in Canada by year-end, Lu said in March. The founder has since said the company’s policies on commenting on financials and future plans have changed and declined to further elaborate on its listing plans and timelines.

Article content

Plant, however, doubts UniUni can hit all three goals concurrently.

Article content

We want more successful companies — the likes of UniUni, Shopify and Clio — and the high-potential citizens they employ, domiciled here

Darrell Kopke, Creative Destruction Lab

Article content

“That’s a pretty far stretch,” he said. “It’s very, very hard to be profitable and growing at the speed that they are.”

Article content

Lu said UniUni “does not operate at a cash burn … and maintains a strong track record relative to the capital raised.”

Article content

Still, any milestone that UniUni hits will mark a win for Canada, according to industry leaders.

Article content

“It attracts attention to the Canadian ecosystem,” Plant said.

Article content

Article content

It also generates spin-off benefits, he said, pointing to the startup booms that companies such as BlackBerry Ltd. and Nortel Networks Corp. created for Kitchener-Waterloo, Ont., and Ottawa.

Article content

“We want more successful companies — the likes of UniUni, Shopify and Clio — and the high-potential citizens they employ, domiciled here,” Kopke said.

Article content

These companies remain a “Canadian story,” given that the intellectual property, jobs and tax base remain in-country, even if most of their revenue and fundraising come from outside of Canada.

Article content

Lu said Canada provided a strong foundation for its launch, but the country’s lack of late-stage funding proved to be a challenge, forcing UniUni to look internationally. Recently, he said he has seen an “encouraging shift (of) a growing appetite among Canadian venture capitalists to back ambitious ventures.”

Article content

For now, in order to maintain its momentum, UniUni must continue to grow fast, sell investors on its growth merits and prove that it can do so while protecting workers.

Article content

Article content

2 weeks ago

2

2 weeks ago

2

English (US) ·

English (US) ·  French (CA) ·

French (CA) ·  French (FR) ·

French (FR) ·