PROTECT YOUR DNA WITH QUANTUM TECHNOLOGY

Orgo-Life the new way to the future Advertising by Adpathway

Article content

(Bloomberg) — Chevron Corp. is reducing local and regional business units in favor of a more centralized model to improve performance and cut as much as $3 billion of costs by 2026.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

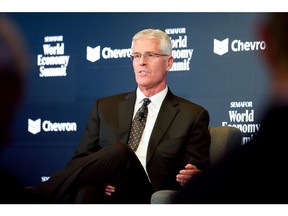

A single offshore division will operate assets in the US Gulf, Nigeria, Angola and Eastern Mediterranean while shale assets in Texas, Colorado and Argentina will also be brought under one roof, Vice Chairman Mark Nelson said in an interview with Bloomberg Tuesday.

Article content

Article content

Article content

Service centers in Manila and Buenos Aires are set to take on finance, human resources and information technology work that used to be done in multiple countries. Centralized engineering hubs are planned for Houston and Bengaluru, India.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“We’re working so hard to simplify our structure, take some layers out so that we can execute faster,” Nelson said. “Best practices are decided upon and applied across the system regardless of what continent they happen to sit on.”

Article content

Low oil prices and an uncertain outlook for fossil fuels have led investors to demand more cash returns from the world’s largest energy companies over the past few years, forcing executives to focus on reducing costs to help fund dividends and share buybacks. Even so, energy stocks now make up just 3.1% of the S&P 500 Index, less than half the weighting a decade ago, despite the US becoming the world’s largest producer of oil and exporter of natural gas.

Article content

Chevron has climbed 5.8% this year as of Wednesday midday trading, ahead of the S&P 500 Energy Index’s 3.1% increase and the wider market.

Article content

“If we’re going to continue to win and be an investment choice in the market, we have to just always be more effective and look for new ways and better ways to work,” Nelson said.

Article content

Article content

The changes, which include the oil major’s production and refining divisions, are part of a plan the oil giant announced in February to reduce its global workforce by as much as 20%, or 9,000 employees, by the end of next year. Structural cost savings between $2 billion and $3 billion could be enough to pay one of Chevron’s quarterly dividends. Last month, Bloomberg News reported on several major changes at Chevron’s trading division, which included promoting some traders and offering severance to others.

Article content

“These are hard decisions for us to make,” Nelson said. “We don’t take them lightly.” He declined to comment on whether the number of US employees would decrease as a result of the growth of global service centers in Asia and Latin America.

Article content

Exxon Mobil Corp. and Shell Plc have or are undergoing similar corporate restructuring and have moved some functions to lower-cost regions.

Article content

Until this year, Chevron ran decentralized global operations with powerful country managers leading large divisions with the ability to adapt to local business conditions. But the company has changed significantly in recent years with the acquisitions of PDC Energy Inc. and Noble Energy Inc. in the US and the completion of major projects such as the expansion of the Tengiz oil field in Kazakhstan. Chevron now wants to speed up execution and use more technology while keeping its “local strength,” Nelson said.

4 days ago

8

4 days ago

8

English (US) ·

English (US) ·  French (CA) ·

French (CA) ·  French (FR) ·

French (FR) ·